Save time and money when declaring your cryptocurrency taxes

Generate your tax report easily, reliably, and at no cost.

Generate your detailed tax report at no cost

Cryptocurrency tax report

Generate your tax report and declare your profits or losses from your cryptocurrency transactions at Bit2Me.

Soon you will be able to connect other platforms to obtain the tax report for all your crypto.

Customers who trust us

Frequently Asked Questions

Do you have any doubts?

Answers to the most common questions about taxes and cryptocurrencies.

It is important to note that the tax regulation of cryptocurrencies may vary in different countries and jurisdictions, and that tax reporting will depend on the specific tax laws and regulations of each location.

In the case of Spain, the Tax Agency has established that cryptocurrencies must be taxed like any other financial asset.

However, each case can be different and needs to be studied in detail.

If you have traded cryptocurrencies and have doubts about how to declare your taxes, it is best to talk to a tax advisor specialized in the field. This expert will be able to help you understand the tax laws applicable to your particular situation and to file your tax returns properly and without errors. This way, you can ensure that you meet your tax obligations and avoid potential penalties or fines.

Most countries treat losses with cryptocurrencies in the same way as gains. Therefore, if you have incurred losses with cryptocurrencies, you must still report those losses to the relevant tax authority in your country.

In the case of Spain, losses with cryptocurrencies can be offset against profits obtained with cryptocurrencies or other financial assets during the same tax year. In addition, if losses exceed profits, the difference can be used to offset profits obtained in future tax years.

It is important to note that each country or jurisdiction has its own tax laws and regulations for cryptocurrencies, so it is advisable to seek advice from a tax professional specialized in your country.

In general, keeping detailed records of your cryptocurrency transactions, including profits and losses, will help you comply with your tax obligations and be prepared to submit accurate and complete reports to the relevant tax authorities in your country.

In general, tax regulations for cryptocurrencies can vary significantly from one country to another. In some countries, all cryptocurrency transactions must be declared, while in others, only the profits obtained from the sale of cryptocurrencies are required to be declared.

In any case, it is important to keep a detailed record of all transactions made with cryptocurrencies, including the date, value and any other relevant information. This will allow you to accurately calculate gains or losses and meet your tax obligations.

It is advisable to consult with a tax advisor specialized in cryptocurrencies to obtain detailed information about the specific tax regulations of each country and to ensure compliance with the applicable tax laws and regulations.

To calculate your profits or losses for tax purposes, you must apply the FIFO (First In First Out) method, whereby the first investments made are the ones you should consider first when selling.

In this way, your profit or loss will be calculated based on the purchase value of a specific currency (starting with the oldest) and its selling value.

To correctly apply this method in calculating the results of your transactions, it is advisable to have a tax advisor specialized in the subject to advise you on the correct way to determine the gain or loss in your cryptocurrency operations.

Airdrops will be subject to income tax in your IRPF, and you must include them in your tax return as capital gains in the general base of the tax, regardless of whether you have sold them or not.

As in other cases, when you use your coins to pay for goods or services, there is an outflow of those coins from your portfolio, resulting in a capital gain or loss.

In cases of sale or exchange of currencies, that gain or loss will be determined by the difference between the purchase value of the currency used and its transmission value. And what is this transmission value? You must use the higher of the following values: the market value of the good or service received or the market value of the currency used in the purchase of the good or service.

Again, it is advisable to consult with a tax advisor specialized in cryptocurrencies to obtain detailed information about the tax regulation of these types of situations, in order to correctly declare these operations to the Tax Agency.

In general, transfers of cryptocurrencies from one wallet to another are not taxable, as they do not generate a capital gain or loss. However, there may be exceptions depending on country specific tax regulations.

In the case of Spain, the Tax Agency establishes that only capital gains or losses generated by the sale or exchange of cryptocurrencies must be declared. Therefore, if you transfer your cryptocurrencies from one wallet to another, but you do not sell or exchange them for another currency, you will not have to declare taxes for this transaction.

In other countries, tax regulations may be different, so we recommend to consult with a tax professional specialized in the subject in your country to determine whether cryptocurrency transfers are taxable.

In general, tax regulations for cryptocurrencies can vary significantly from country to country.

In Spain, the returns generated by cryptocurrencies through any earn, staking, lending, or yield farming service must be considered as a change in wealth, and therefore, must be declared.

Tax can help you keep track of all your cryptocurrency transactions on Bit2Me, as well as calculate your profits or losses and generate tax reports.

Tax will perform the necessary calculations to generate accurate and detailed tax reports, making it easier for you to file your taxes in relation to your Bit2Me transactions.

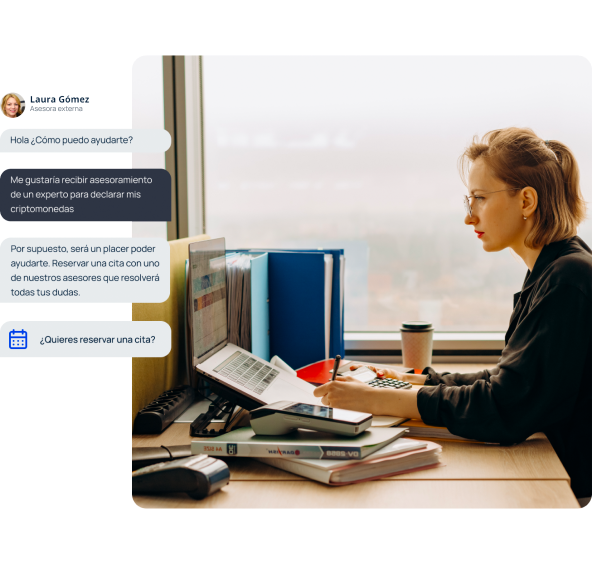

Yes, if you have doubts it is advisable to have the help of a tax advisor specialized in cryptocurrencies to keep an accurate control of your cryptocurrency operations and declare them correctly.

Tax regulations around cryptocurrencies can vary significantly from one country to another and can be complicated to understand. A tax advisor specialized in cryptocurrencies can help you understand the tax laws applicable to your particular situation and ensure you comply with them.

With the help of a tax advisor specialized in cryptocurrencies you can save time and effort, as well as ensure that you comply with your tax obligations properly.

With Tax you will be able to generate a detailed tax report of all your cryptocurrency transactions made in Bit2Me at the end of the tax year.

If needed, you can also export a history of your transactions in CSV format to use in other cryptocurrency tax calculation applications by accessing Tax and clicking on the "Download transaction history (CSV)" button.

It is important for cryptocurrency owners to be aware of and comply with the tax regulations applicable in their country to avoid potential legal and tax penalties.

In the case of Spain, if an individual does not correctly declare his or her cryptocurrencies, the Tax Agency may request documents and reports to justify the lack of declaration and confirm that there was no patrimonial variation.

If it is determined that the cryptocurrencies were not declared correctly, the Tax Agency could apply fines and surcharges for non-compliance with tax obligations.

In case of doubts, it is advisable to consult with a tax advisor specialized in cryptocurrencies to obtain detailed information about the specific tax regulations of each country and ensure compliance with the applicable tax laws and regulations.

To download your tax report, you must have made some transaction on the platform. Additionally, you need to have at least Level 1 in Space Center.

Once you have met these requirements, you will be able to access Tax and download the reports for the years in which you have made transactions.